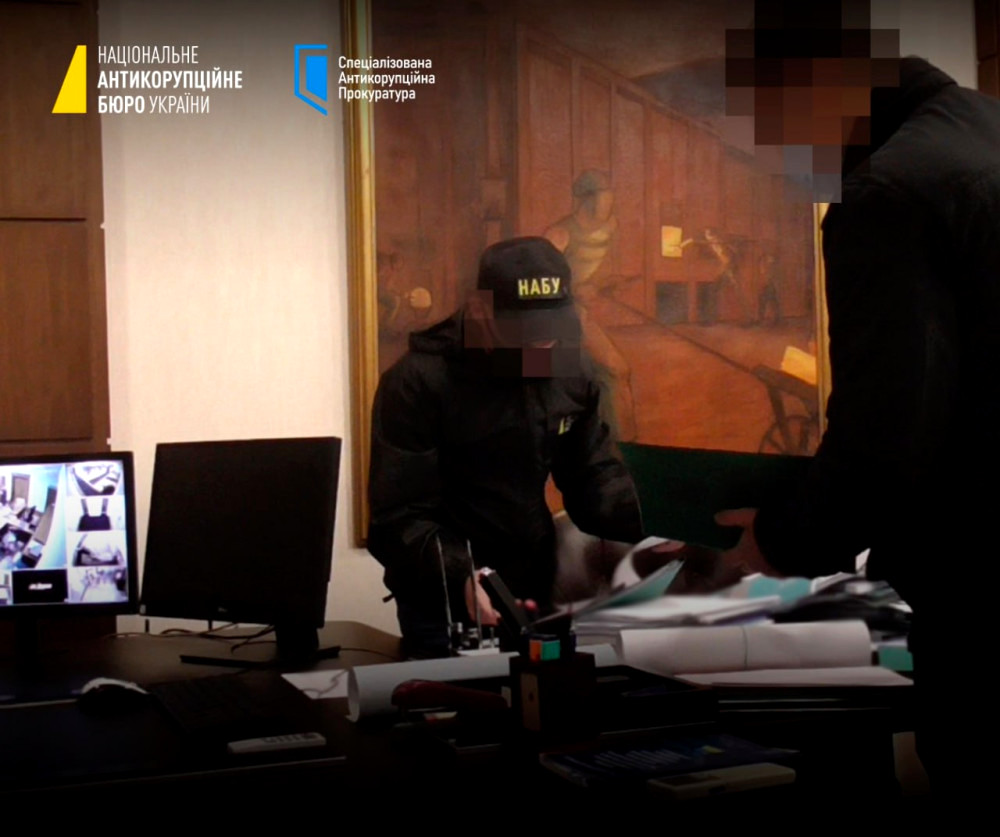

In a joint operation, NABU, SAP, and the Security Service of Ukraine have exposed the involvement of former leaders of the State Tax Service of Ukraine in abusing their positions for the benefit of a criminal organization.

According to the investigation, members of the organization created a conversion center and engaged over 200 controlled companies to implement a scheme for tax evasion.

The criminal mechanism included:

- the creation of false tax invoices by controlled companies regarding business relations with legitimate enterprises;

- registration of these invoices in the Unified Register of Tax Invoices;

- the use of these invoices by actual businesses to reduce their tax liabilities.

From 2020 to 2023, the conversion center issued tax invoices with false information about the supply of goods and services totaling 15 billion UAH, and the “scheme” VAT amounted to over 2.3 billion UAH.

The investigation revealed that the acting head of the State Tax Service of Ukraine facilitated the smooth operation of the conversion center, while the deputy head of the Main Department of the State Tax Service in the Poltava region, who chaired the commission for stopping the registration of tax invoices, ensured decisions were made in favor of the conversion center's companies. As a result of these operations, legitimate businesses unjustly avoided paying 147 million UAH to the state budget. Currently, 11 individuals have been notified of suspicion.