In the first half of 2025, Ukrainian banks earned 100.06 billion UAH before taxes. This figure is nearly the same as last year's result.

This information is reported by Opendatabot.

Tax expenses amounted to 21.99 billion UAH, which is 22% of the profit. After taxes, 78.07 billion UAH remained, according to the analysis.

However, as noted by Opendatabot, not all financial institutions reported profits during the first half of the year: 13 banks reported losses. Currently, every fifth bank in the country is operating at a loss.

Even those that are profitable do not always show growth: more than a third of profitable banks improved their metrics, according to the study. The leader in dynamics is Metabank, which increased by 118 times. Privatbank shows stable growth: +14%.

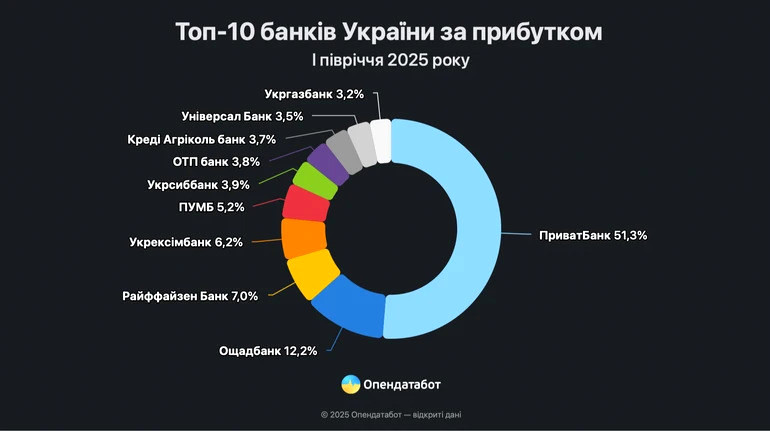

The top 10 largest banks remained unchanged. Together, they generated 68.05 billion UAH, which is 87% of the sector's total profit.

Almost half of all Ukrainian banks' profits come from Privatbank: 34.88 billion UAH profit and 11.09 billion UAH in taxes. Among state banks, only First Investment Bank is in the negative (-29.43 million UAH). Motor Bank, on the other hand, this year returned to profit for the first time in a long time. Overall, the profit of the group of state banks grew by 4% compared to the same period last year — mainly due to the leader, according to the analytics.

In contrast, foreign banks saw a nearly 25% decline in profits, totaling 16.57 billion UAH. Raiffeisen remains the leader with a +10% increase, 4.74 billion UAH profit, and 1.66 billion UAH in taxes.

Private capital banks also faced a quarter loss, their profit amounted to 10.06 billion UAH. PUMB remains first with 3.57 billion UAH — a decrease of 7% compared to last year. Together with Universal Bank (Monobank), they accounted for 59% of the group's profit.

More than a quarter of private banks in the country closed the first half of 2025 with losses.